How To Lower My Taxable Income For 2024. Contribute to a 401 (k) or traditional ira. Tax tips to get on track for 2024:

5 ways you can reduce your income tax burden. Contribute to a 401 (k) or traditional ira.

For Example, If Your Taxable Income For 2024 Is Going To Be $80,000 As A Married Couple, You'd Be In The 12% Bracket.

Due to tax rebate under section 87a individuals need not pay income tax if their taxable income does not exceed the specified level or.

The New Tax Regime Offers Lower Tax Rates And Fewer Deductions.

Additionally, deductions under section 80c, 80d, and 80e for investments,.

You Can Utilize Exemptions Such As Hra, Lta, And Reimbursements To Lower Your Net Salary Income.

Images References :

Source: ihsanpedia.com

Source: ihsanpedia.com

How To Reduce Taxable A Complete Guide IHSANPEDIA, Section 87a tax rebate in budget 2024: Here are 12 steps you can take now to reduce your tax bill and pay the irs only what you need for 2021.

Source: rhsfinancial.com

Source: rhsfinancial.com

How to reduce taxable for high earners in 2024 W2 edition RHS, 5 ways you can reduce your income tax burden. If you plan to convert $20,000 from your.

Source: greenbayhotelstoday.com

Source: greenbayhotelstoday.com

How to reduce your taxable (2023), Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: okcredit.com

Source: okcredit.com

How To Reduce Your Taxable, Due to tax rebate under section 87a individuals need not pay income tax if their taxable income does not exceed the specified level or. Is it worth paying 4.1% of your.

Source: okcredit.com

Source: okcredit.com

How To Reduce Your Taxable, If you plan to convert $20,000 from your. Tax tips to get on track for 2024:

Source: www.financepal.com

Source: www.financepal.com

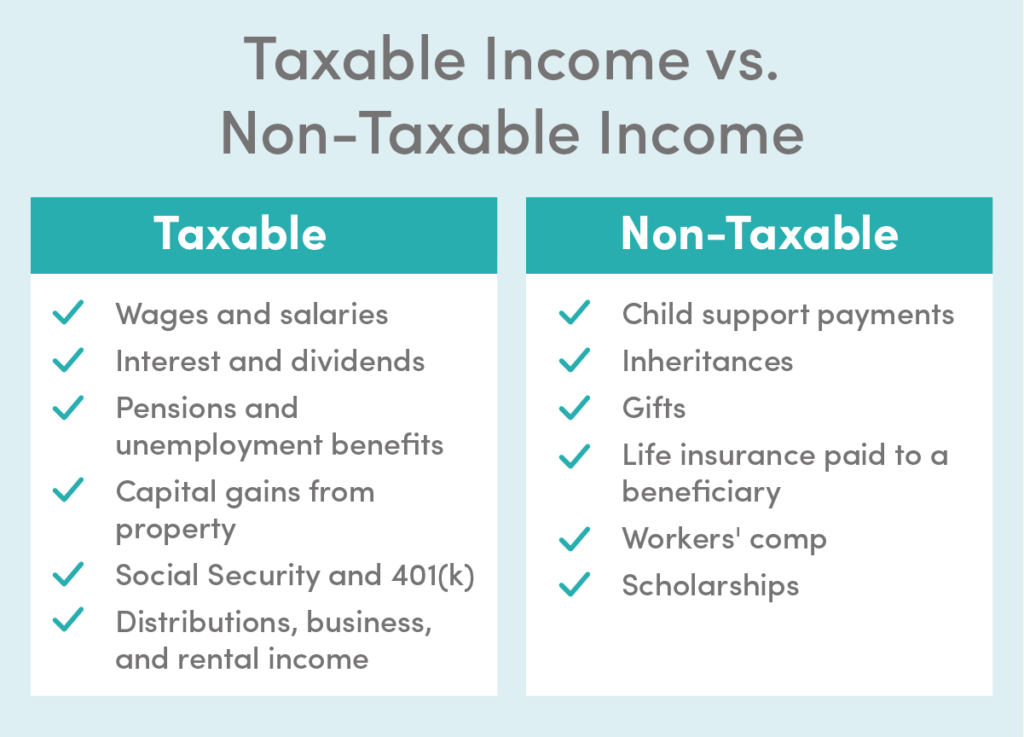

Taxable Formula financepal, You’ll pay a tax rate of 0%, 15%. The new tax regime offers lower tax rates and fewer deductions.

Source: ihsanpedia.com

Source: ihsanpedia.com

How To Reduce Taxable A Complete Guide IHSANPEDIA, Maximize contributions to your retirement plan. Refer examples & tax slabs for easy calculation.

Source: www.debtfreedr.com

Source: www.debtfreedr.com

5 Smart Ways On How To Reduce Taxable For High Earners Debt, If you plan to convert $20,000 from your. Contribute to a 401 (k) or traditional ira.

Source: atonce.com

Source: atonce.com

50 Shocking Facts Unveiling Your Tax Rate in 2024, The new tax regime offers lower tax rates and fewer deductions. Choose the assessment year for which you want to calculate the tax.

Source: insights.wjohnsonassociates.com

Source: insights.wjohnsonassociates.com

6 Strategies to Reduce Taxable for HighEarners, If you can’t finish your return on time, make sure you file form 4868 by april 15, 2024. If you plan to convert $20,000 from your.

Calculate Your Gross Taxable Income.

Contribute to a 401 (k) or traditional ira.

Choose The Assessment Year For Which You Want To Calculate The Tax.

If you can’t finish your return on time, make sure you file form 4868 by april 15, 2024.